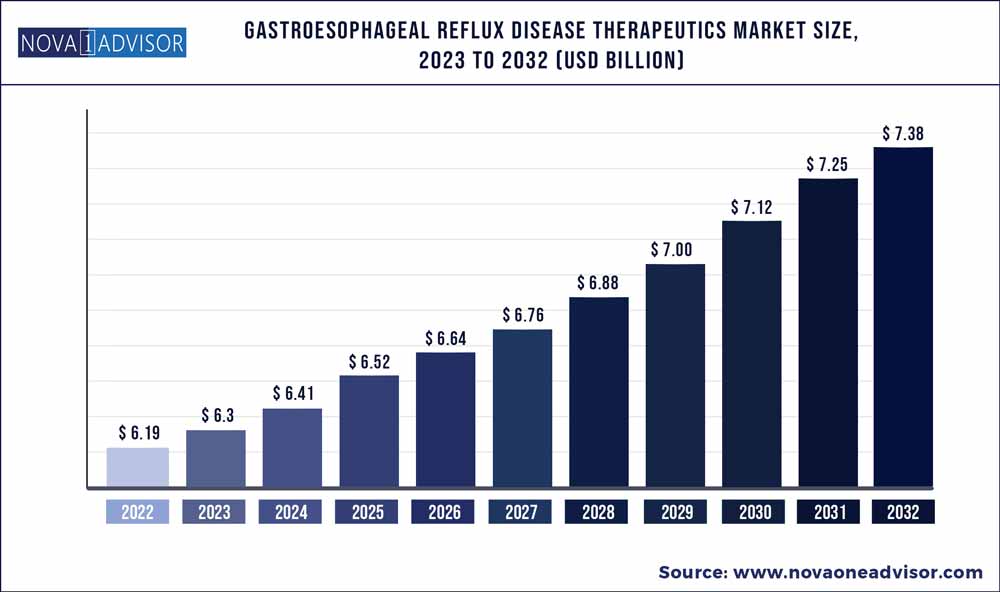

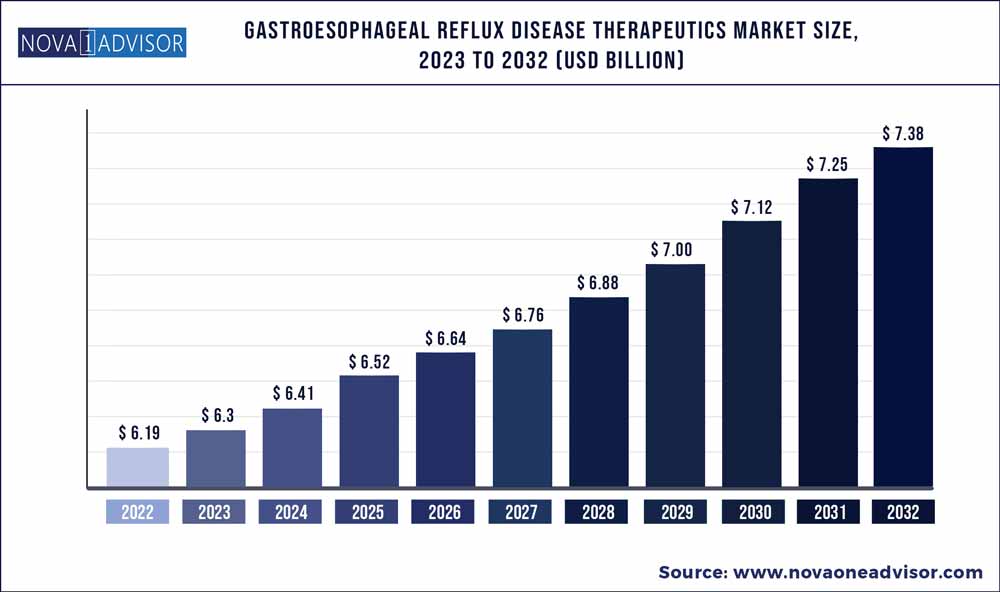

The global gastroesophageal reflux disease therapeutics market size was exhibited at USD 6.19 billion in 2022 and is projected to hit around USD 7.38 billion by 2032, growing at a CAGR of 1.77% during the forecast period 2023 to 2032.

Key Pointers:

- Antacids segment dominated the gastroesophageal reflux disease treatment market in 2022 and is attributable to the rapid and quick relief offered by antacids, as they tend to counteract the acidity inside the stomach

- Untreated condition owing to unnecessary condition that leads to additional medical issues is propelling the demand for proper therapeutics.

- Key players operating in the market are focusing on developing medications that helps in curbing the uncomfortable condition occurring through GERD

- North America held the largest market share which can be attributed to the increasing technological advancements in diagnostics technologies that facilitate rehabilitation of disabled patients

Gastroesophageal Reflux Disease Therapeutics Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 6.3 Billion |

| Market Size by 2032 |

USD 7.38 Billion |

| Growth Rate from 2023 to 2032 |

CAGR of 1.77% |

| Base year |

2022 |

| Forecast period |

2023 to 2032 |

| Segments covered |

Drug type |

| Regional scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key companies profiled |

AstraZeneca; Eisai Co. Ltd.; GSK plc.; Takeda Pharmaceutical Company Limited.; Ironwood Pharmaceuticals, Inc.; Johnson & Johnson Services; Inc.; SFJ Pharmaceuticals; Sebela Pharmaceuticals; Phathom Pharmaceuticals Inc.; Camber Pharmaceuticals Inc.

|

The growth is attributed to increasing prevalence of gastroesophageal reflux disease and other gastrointestinal diseases. Moreover, change in lifestyle and food habits, low success rates associated with GERD management devices and increasing demand for self-medication is further propelling the industry growth.

Increasing prevalence of gastroesophageal reflux and other gastric disorders is propelling the growth of the market. For instance, it is estimated that around 13.98% of total population is affected by GERD, which equals to around 1.03 billion people suffering from GERD globally. The rising incidence of the condition propels the need for proper treatment. Individuals using over-the-counter medication to treat unidentified problems may be at a higher risk. Untreated GERD condition not only increases uncomfortableness but may result in a number of additional medical issues.

Treatment of GERD generally includes lifestyle modification, surgical therapy, and medical therapy. Patients who do not respond to lifestyle changes receive a therapeutic intervention. Antacids, antisecretory drugs like PPI treatment or histamine (H2) receptor antagonists (H2RAs), and prokinetic drugs make up therapeutics. Famotidine and cimetidine are two H2RAs that have been licensed by the US Food and Drug Administration (FDA) and are currently offered over the counter in the US. Because of an unanticipated impurity in the active ingredient, the other H2RA that is frequently used, ranitidine, has been recalled due to a potential health risk or safety concern.

Furthermore, key players are focusing on incorporating gastroesophageal reflux disease therapeutics. For instance, in May 2022, Phathom Pharmaceuticals announced FDA approval for Vonoprazan, a NDA for the treatment of adults with all grades of erosive esophagitis and to provide healing and relief from heartburn. Moreover, in November 2022, JB Pharma launched RANRAFT, a novel formulation that helps in providing quick relief for acid reflux and heartburn.

North America dominated the overall gastroesophageal reflux disease treatment market in 2022, which can be attributed to the increasing adoption of GERD therapeutics owing to the increasing prevalence of GERD in the regional population. For instance, according to a study published in the journal GUT, the prevalence of GERD in North America was 18-28%. Moreover, there are increasing initiatives on spreading awareness about the condition in the population, further increasing the demand for GERD therapeutics. For instance, in November 2022, EndoGastric Solutions, Inc. launched a national campaign for supporting GERD awareness week. The aim of the campaign was to provide easy-to-follow reflux-friendly recipes for people suffering from GERD. The growth in the region is also supported by key players focusing on new product launches. In October 2022, Sebela Pharmaceuticals entered into a strategic collaboration for the development and commercialization of Tegoprazan in Canada and the U.S.

Asia Pacific is estimated to show the fastest growth over the forecast period. The growth of the market in the region is due to increasing awareness among the target audience regarding the treatment of the condition, increasing incidences, and an increasing focus by key market players to expand their product portfolios. In March 2022, Vonoprazan, an FDA-approved drug developed by Phantom Pharmaceuticals, was made commercially available in Japan and other Asian countries for the treatment of GERD. Moreover, a number of players have expanded their presence in Asia owing to increasing demand for GERD therapeutics in the region.

Some of the prominent players in the Gastroesophageal Reflux Disease Therapeutics Market include:

- AstraZeneca

- Eisai Co., Ltd.

- GSK plc.

- Takeda Pharmaceutical Company Limited.

- Ironwood Pharmaceuticals, Inc.

- Johnson & Johnson Services, Inc.

- SFJ Pharmaceuticals

- Sebela Pharmaceuticals

- Phathom Pharmaceuticals, Inc.

- Camber Pharmaceuticals, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Gastroesophageal Reflux Disease Therapeutics market.

By Drug Type

- Antacids

- H2 Receptor Blockers

- Proton Pump Inhibitors (PPIs)

- Pro-kinetic agents

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)